Using market data to avoid being outflanked and build better homes

As you probably know, there are around 1,400 housing associations in the UK and close to 400 local authorities, not to mention thousands of private development and investment companies, all of whom are competing to build the best possible homes for their respective markets.

Although it’s not like we’re building enough housing. Even with the pandemic leading to the exodus of around one million Europeans who had been living in the UK, the country is still short of around 2.5 million homes. However, affordable housing (particularly affordable rented housing) has been a strong area for development, even during the pandemic.

With vast demand for housing relative to supply, some might think that the solution to the housing affordability crisis is a case of ‘build anything anywhere’, but most professionals will know that the process of site finding and rent setting is far more complicated and nuanced than that.

This is where technological improvements over the past few years are having a significant impact on helping housing providers find, price, develop and maintain housing sites, particularly for rent.

Finding a site

There are two ways to find a site, proactive and reactive. In the latter case, someone (perhaps an agent or the owner) brings the site to you. It may be competitive, it might be completely off-market. This works well a lot of the time because you know the seller actually wants to sell, and then you just need to determine viability.

However, what about when you’re looking at site assembly, or you have a sense that a particular location needs housing, but no-one has come to you to ask for a bid?

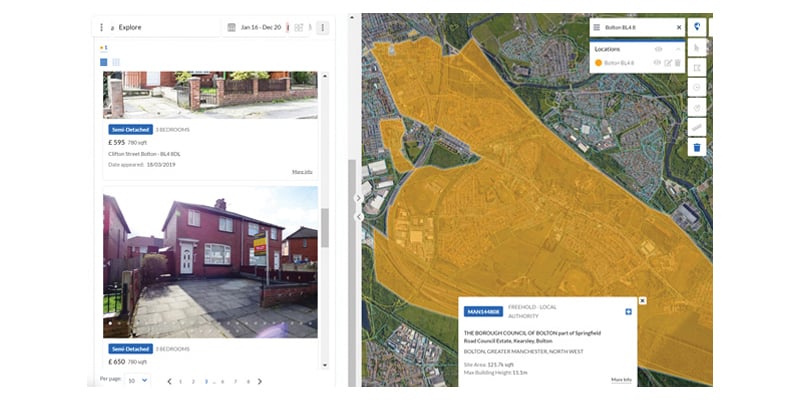

That’s where being proactive comes in, and that’s where new technology can help. A range of different providers now exist who can help you to identify sites and their owners. However, what is really crucial is understanding what you can do with a site, which is determined by the local housing market, economics and planning regime.

By taking those into account, you can now virtually ‘visit’ sites and understand quickly and easily how they might present an opportunity for development or investment, passing on those you need to pass on, and investigating further those which look like they might have potential.

Determining the price

What is a fair market rent in a location? And from that, what is the relevant affordable rent or social rent (if not set by the local authority)? In the past, understanding the appropriate rent level could be a complex activity of checking portals, calling agents and referring to local authority guidance. Now decades of rents combined with property characteristics and LHA data is instantly available, including the elusive ‘achieved rent’ rate.

Armed with this information, housing providers can easily determine the fair market rent and set an appropriate discounted rent or affordable rent in their viability models.

When interest-cover ratios define the viability of finance, it’s essential to know the realistic level of achievable rent for a new development as well as what is truly affordable in order to strike the right balance between ensuring a development is financially viable and providing the best value to tenants.

Developing the site

This is where the data really comes into its own by enabling housing providers to understand the competitive landscape – where gaps and opportunities exist, understand what tenants value and where housing is needed most.

For example, identifying that the monthly rent of a property with a small garden is £50/month more than without a garden. Or that a series of new planning applications have been submitted in an area that either requires an affordable housing component or may change the nature of the area, thereby creating other interesting development opportunities. Or that in a particular location there is little difference between the local housing allowance and the affordable rent, potentially allowing for partnerships with local authorities. Or that one location has a relatively high cost of living and a growing population but a large amount of disused space which could be perfect for redevelopment.

Using a range of systems which incorporate market data, socio-economic data, consumer data and competitive information can provide deep insights into the market and give you a strong indication of exactly what is needed, where and for whom.

Maintaining the properties

Lease renewals are obviously just as important as finding new tenants, but how do you know if you’re setting the correct rent level? You could ask an agent, you could look at your own portfolio or you could look online. But in each instance, you’ll tend to see only part of the picture and having the wrong information when it’s time for renewals can be highly problematic.

With rents typically linked to inflation or a highest recent comparable, and inflation historically almost always positive, there is little opportunity for rents to decline. However when the market shifts rapidly as it has done now twice in a dozen years, those who can see what’s happening and react to it quickly tend to do better because they can keep up with changes in the market, both on the way down and on the way up.

A housing provider’s tenant wanting to reduce their rent (for whatever reason) but finding only the same or higher price may instead just move out if they can. If that happens en masse, it can create problems for that housing provider. Instead, by keeping an eye on the market and market rents, housing providers can more easily adjust rents to keep them affordable.

Ben Potter, data analysis & evaluation officer, Liverpool City Council, said, “Realyse has been a welcome addition for us. It quickly helps our officers to visualise market activity as a backdrop to our reactive and proactive housing work.

“Having an analytical tool that accelerates the process of understanding sales, rental and planning trends at a pretty granular level enables us to gain more insight, challenge existing preconceptions and help focus our resources better.”

As more housing providers and local authorities use Realyse and other technologies in their decision-making processes, we expect to see greater clarity in the market. This will hopefully help everyone to more easily understand where, what and when to build, and in doing so, avoid competition with each other and with other parts of the market.

We’re already helping organisations such as Places for People, Liverpool County Council and L&Q with market data and we hope that the advantages they see from using our technologies and those from other suppliers spread across the sector, leading to improved outcomes for tenants and businesses alike.

Gavriel Merkado is the founder & CEO of Realyse.